How Payment Links Can Simplify Payment Collection for Freelancers, Creators, and Small Businesses This Ramadan

Payment links let you collect payments anywhere, including WhatsApp, Instagram, email, and more, even without a website. A simple and powerful way to get paid.

Innovative business models like the creator economy, the freelancer economy, and social commerce are overtaking traditional ones. More than 200,000 content creators in MENA and 1.56 billion freelancers worldwide are leading the shift.

These models need flexible payment products that keep up. Payment links are the perfect fit for the new creator economy.

This straightforward payment product is ideal for small businesses, social commerce entrepreneurs, and freelancers. It offers a convenient way to collect payments online, with support for multiple payment methods.

What Are Payment Links and Why MENA Businesses Need Them

Payment links let businesses accept online payments—no website or technical setup required. They’re fast to create, customizable with product details and branding, and perfect for small businesses, freelancers, and social sellers.

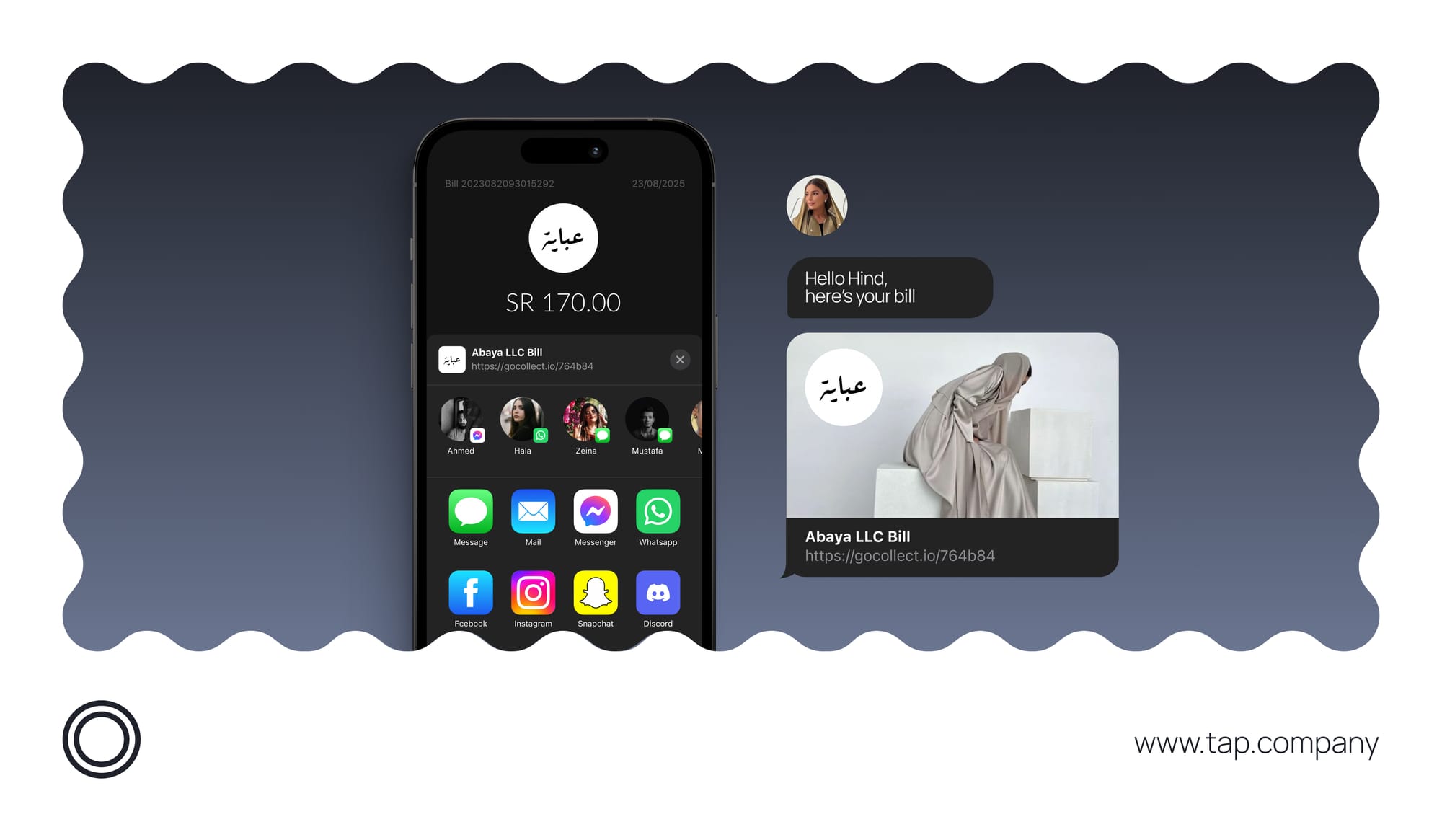

Also known as checkout links, they can be shared as clickable URLs or scannable QR codes across social media, messaging apps, websites, or even printed invoices.

When a customer clicks the link, they’re taken to a secure checkout page to complete the payment. Payment links work for both one-time transactions, like invoices, or multiple transactions, such as a buy button on a social media platform.

Key Benefits of Payment Links for MENA Busineses

Now that we’ve covered what payment links are, here’s why they matter:

1. Simple and Easy to Use

Create a link, share it, and get paid in seconds. No complex setup, no hassle.

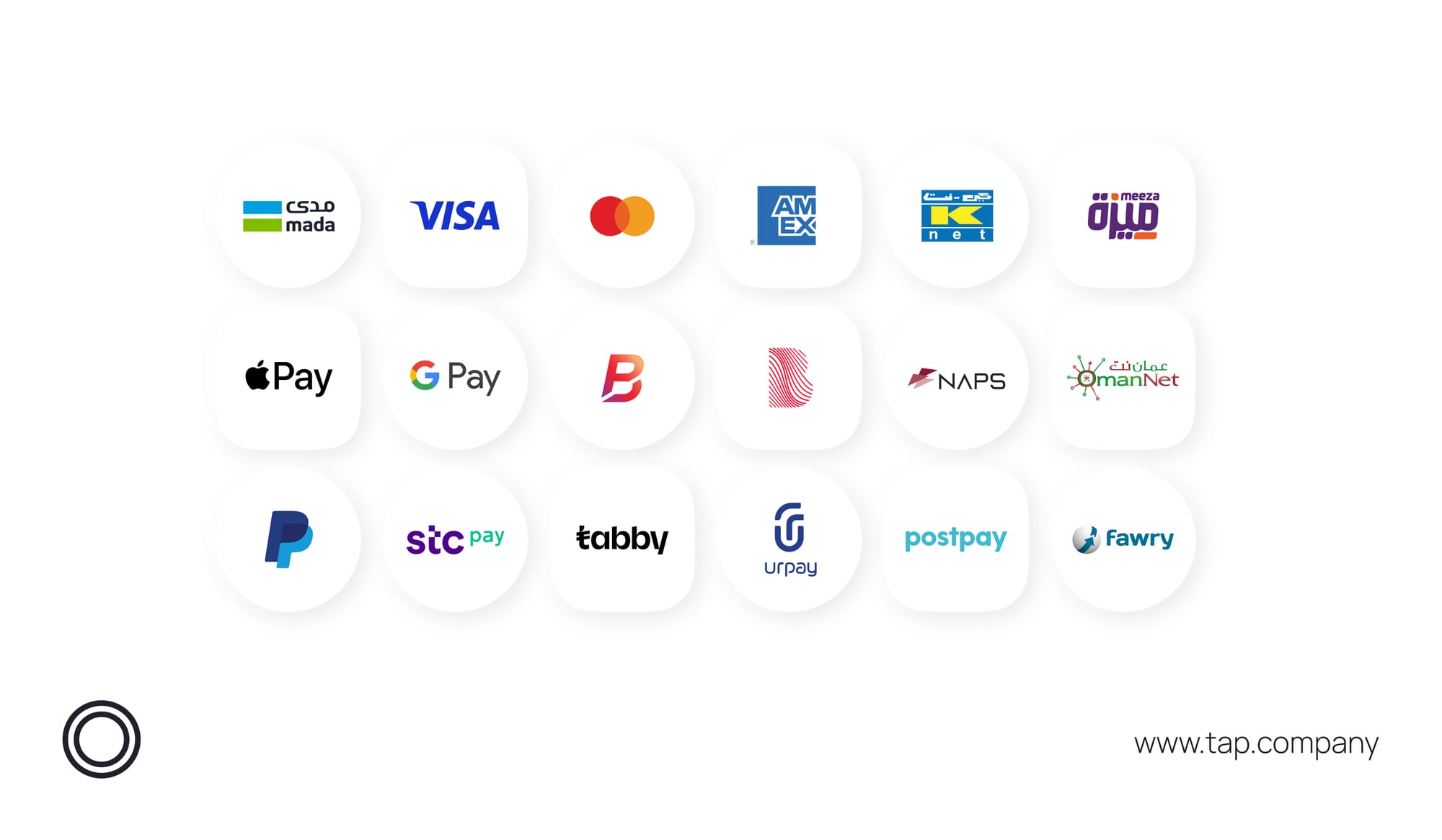

If you're a social media influencer selling Ramadan gift boxes or a freelancer offering last-minute design services, you can send a payment link with the exact amount due. Customers simply click, choose their payment method, and pay instantly using Apple Pay, Visa, Mastercard, and many more local options like mada, KNET, and Benefit—all supported by Tap Payments.

2. Maximize Sales During Ramadan’s Rush

Ramadan shoppers want speed and convenience, whether they’re buying gifts, stocking up on groceries, or donating to charity. Payment links let customers complete purchases instantly without switching apps or websites.

A smooth checkout experience boosts satisfaction and encourages repeat business. Keep sales moving without friction this Ramadan.

3. Supports Multiple Payment Methods

Give customers the freedom to pay their way. Payment links allow customers to use their preferred payment methods, such as global credit cards (Visa, Mastercard), local payment options (mada, KNET, Benefit), and alternative methods like Apple Pay, Google Pay, and BNPL options like Tabby.

4. Track Payments Easily

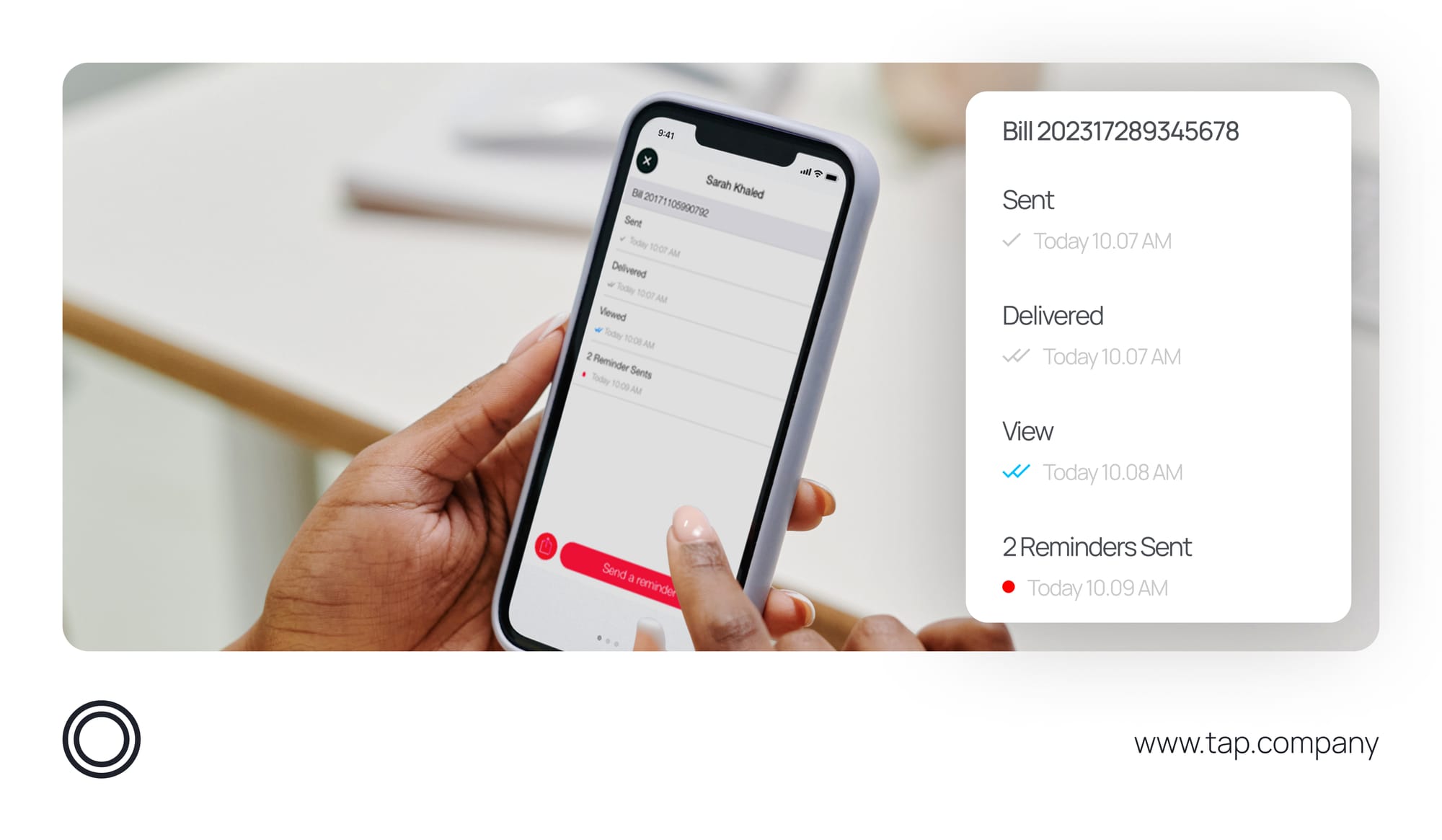

Stay on top of your sales with real-time tracking and detailed reports. Payment links let you monitor transactions, track pending payments, and analyze sales trends—all from your phone.

For example, a home-based bakery selling traditional Ramadan desserts can instantly see which items are selling the most, manage orders, and follow up on unpaid invoices, ensuring smooth operations during the busy season.

Who Benefits from Payment Links? (Hint: Everyone!)

Payment links give businesses and individuals a fast, flexible way to get paid:

✔ Freelancers & consultants – Get paid easily for projects or services.

✔ Social sellers – Send payment links on Instagram, WhatsApp, and more.

✔ Small businesses – Accept payments without a website.

✔ Ramadan promotions – Offer seamless checkouts to increase sales.

How to Set Up and Use Payment Links

1. Choose a Payment Links Provider

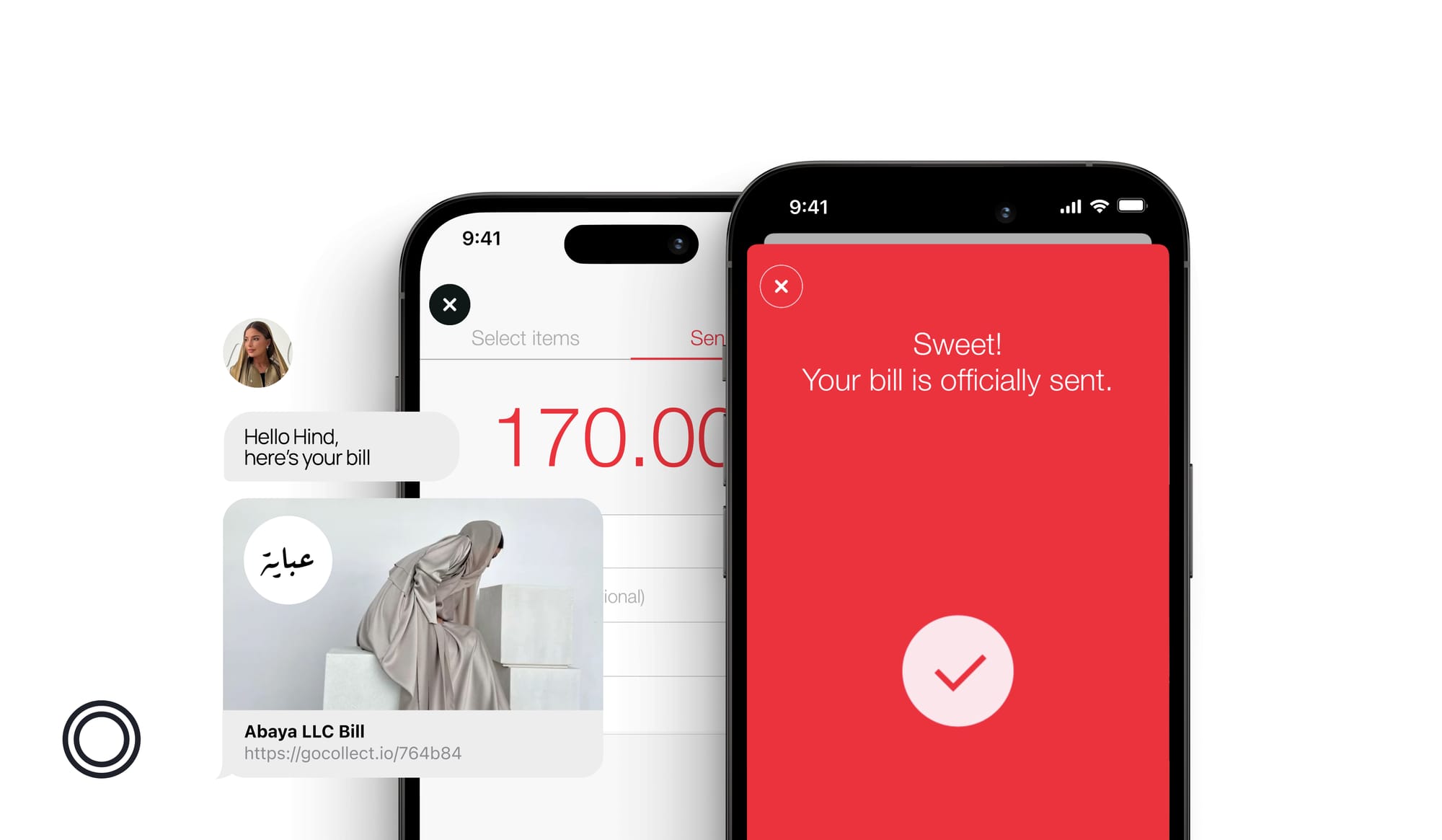

Compare providers based on transaction fees, supported payment methods, and features. Try our Billing App and send payment links easily.

2. Create a Payment Link

Log into your account, go to the payment links section, and generate your link. Customize it with product details, pricing, and branding.

3. Share the Payment Link

Send the link via email, SMS, social media, or embed it in invoices and receipts. For Ramadan promotions, include payment links in festive WhatsApp messages or social media deals to drive quick sales.

4. Track Payments

Monitor transactions with real-time payment tracking, helping you stay on top of sales and pending payments.

Make Payments Easy This Ramadan

Payment links offer a simple, secure, and efficient way to accept online payments. Perfect for businesses, freelancers, and social sellers during Ramadan. With easy setup, multiple payment options, and real-time tracking, they help you focus on what matters most: delivering value to your customers.

Our recommendation?

Download our Billing App! You can offer all the payment methods you need to sell successfully across MENA. Features like real-time bill tracking, and 24/7 live chat on our website make it a must-have for businesses.

Join 120,000+ businesses across MENA using Tap Payments and make online payments stress-free this Ramadan!