Tap into MENA's eCommerce Surge: Your guide to cross-border success with local payment methods

The global eCommerce landscape is surging, with the Middle East and North Africa (MENA) standing out as a beacon of growth. With projections by the Middle East and North Africa eCommerce Association (MENA ECA) placing the region's online sales at an impressive $69.5 billion by 2023, it's evident that MENA is on a trajectory to reshape eCommerce.

Coupled with this growth is the rise of cross-border eCommerce, which has seen businesses erasing boundaries and expanding not only across MENA but also globally.

However, cross-border eCommerce in MENA brings its own set of challenges.

Among these are the region's fragmented payment systems and issues tied to product delivery speed and costs. Thankfully, innovative startups are springing up, leveraging digital payments, last-mile logistics, and mapping tech to alleviate these complications.

In this post, we zoom in on the specifics of MENA's payment landscape and provide insights on navigating them as a growing business.

Understanding MENA's varied online payment landscape

While Visa and Mastercard dominate on a global scale, MENA presents a vibrant mosaic of online payment methods.

Take Saudi Arabia, where mada cards make up over 90% of issued cards and account for more than 95% of transactions. In such a landscape, offering mada isn't just beneficial—it's vital for trust. Especially since cash is only used in 13% of eCommerce transactions in the Kingdom.

In contrast, Egypt’s large unbanked population leans towards cash for online shopping. But not in the traditional cash-on-delivery sense. The local payment method Fawry allows users to process payments online through a unique code, which they can then settle in cash at a nearby outlet.

Digital wallets are also growing in popularity across the Middle East. It’s already the second leading online payment method in MENA with a 50% share and is expected to continue growing throughout 2026.

This growth is pushed by international brands such as Apple Pay, Google Pay, and PayPal, however, local brands such as STC Pay (Saudi), BenefitPay (Bahrain), and CareemPay (UAE) are also gaining popularity.

Historically, businesses primarily offered local payment methods in their home country and depended on international card schemes elsewhere. This approach frequently deprived shoppers from outside the origin country of the trusted and familiar payment options they often use.

Furthermore, even when businesses believe they are providing local payment methods, many paytech providers process them as global transactions. This is because most local cards are co-branded with global players like Visa or Mastercard, resulting in significantly higher costs for businesses.

How to easily scale across MENA with localized payments

Successfully selling cross-border across MENA hinges on partnering with a payment provider well-versed in the region's diverse payment preferences. So here are some things you need to consider to ensure that you select the right payment partner for your global business!

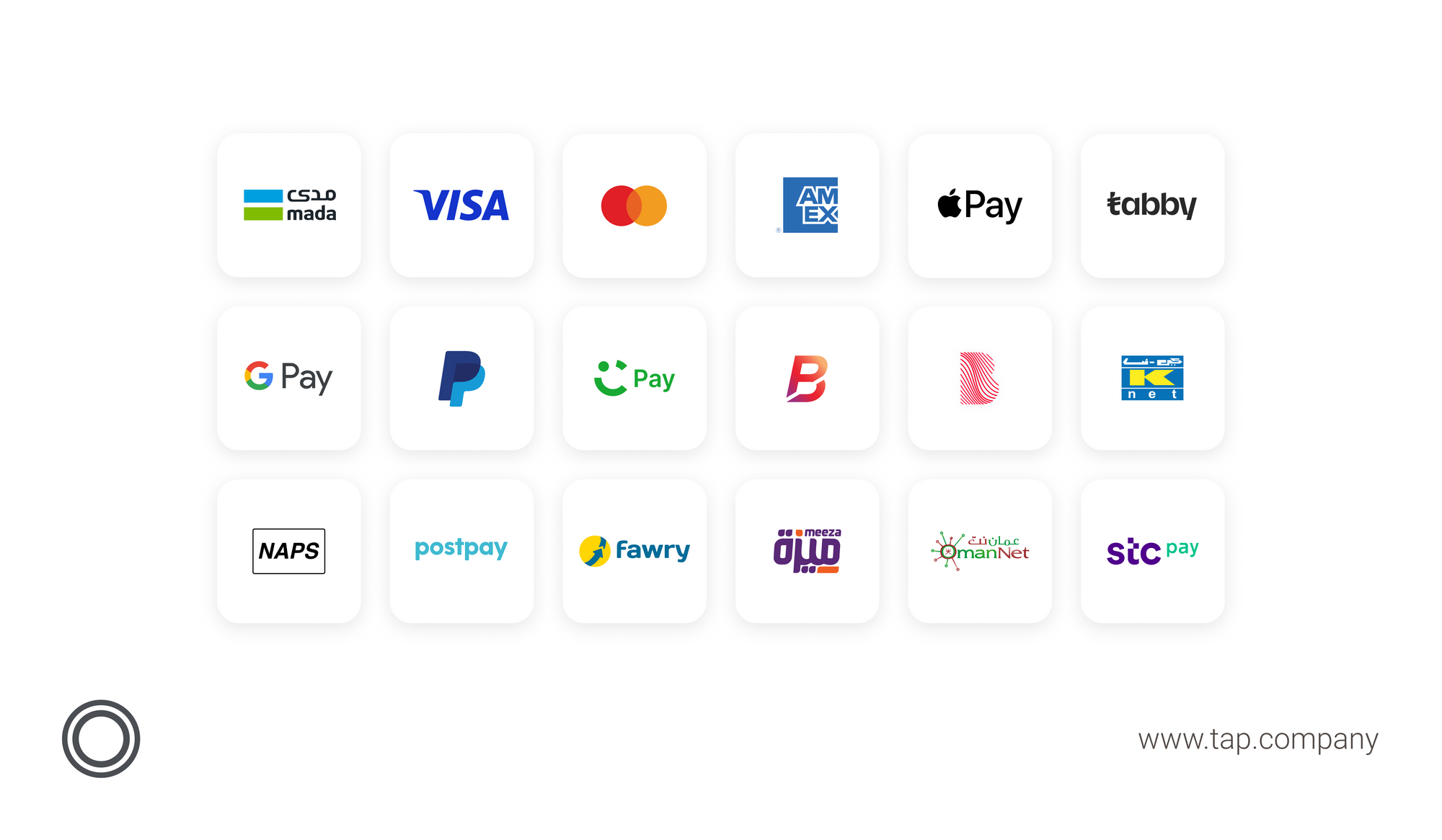

Payment methods supported

As mentioned, one of the cornerstones to successfully sell across MENA is to choose a payment partner that understands and can help you easily offer not only the payment methods popular in the country you’re based in but also all the diverse payment preferences across the region.

Customers are more inclined to finalize their purchases when presented with their preferred payment options and a localized payment experience. Falling short might lead to cart abandonment or missed opportunities.

Without this versatility, businesses might also find themselves partnering with multiple paytech providers, signing multiple contracts, and unnecessarily complicating their operations.

Reduced costs with local payment options

In the realm of payments, cost should always be an important consideration. Why? Because processing payments using local methods is generally more affordable than handling them as international transactions. With Local Acquiring, cross-border transactions across MENA can be processed as if they're local.

This often results in faster and more cost-effective outcomes. By partnering with a payment gateway connected to domestic banks and local currencies in each country, businesses can not only reduce expenses but also enhance the customer experience. Choosing paytech providers with the capability for local acquiring across MENA can thus be a game-changer.

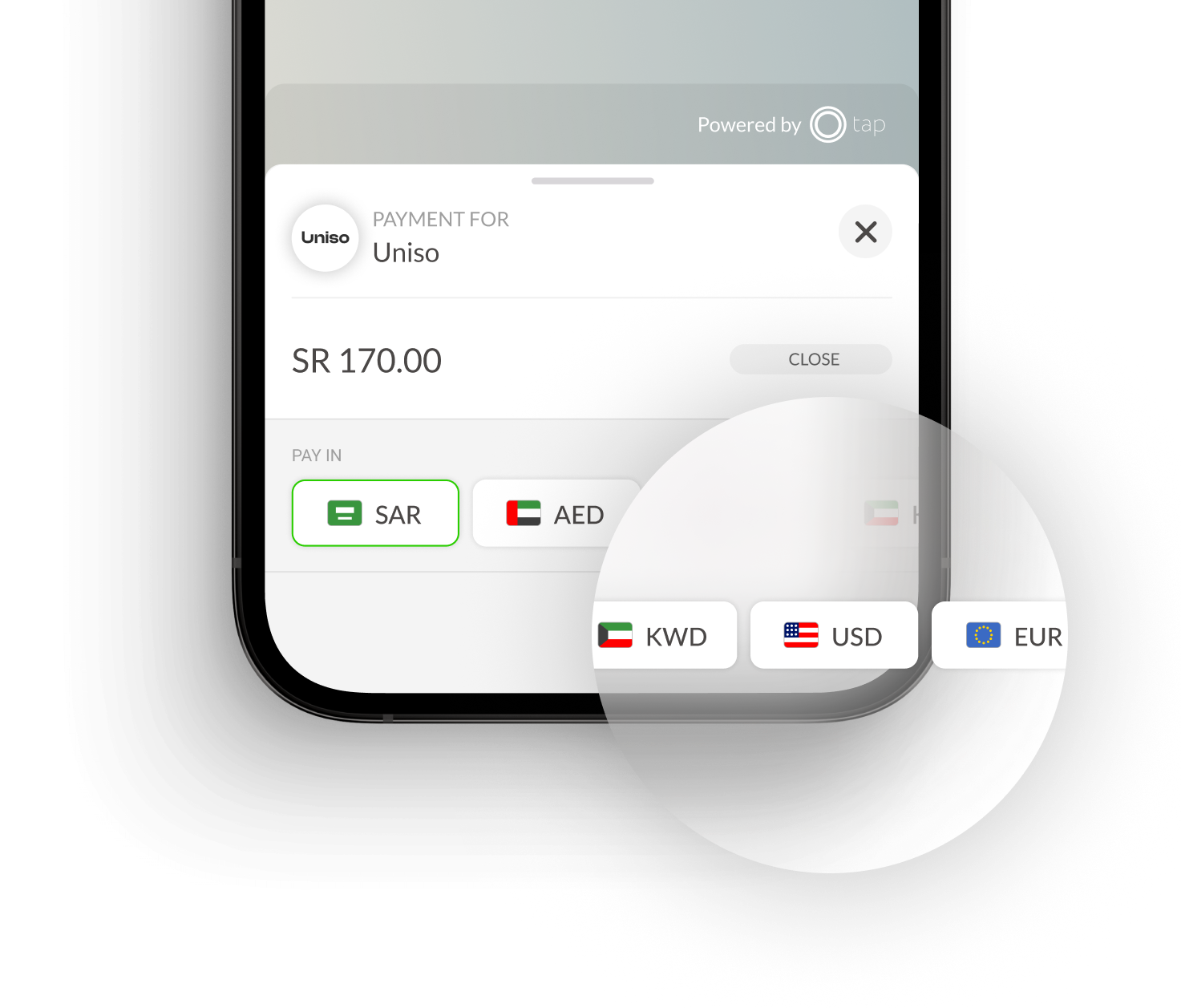

Multi-currency options

When customers can pay in their preferred currency, their trust in your brand elevates, and the chances of cart abandonment reduce. This flexibility not only enhances user experience but also positions your business as truly global, catering to diverse customer preferences seamlessly.

Clarity in currency conversion is also something businesses need to look out for. Partnering with a payment platform that transparently details how currency conversion rates are calculated simplifies account reconciliation for businesses. It eliminates guesswork and potential discrepancies, ensuring both the business and its customers are on the same page.

Flexible banking relationships

Choosing a paytech provider that can pay out to any bank across the MENA region is important for businesses aiming to scale in cross-border selling.

When you accept local payment methods and currencies from different countries, it's vital to ensure that you can effortlessly convert and deposit these funds into your own currency in your local bank account.

A versatile paytech partner eliminates these challenges, streamlining your financial processes. This isn't just about current convenience—it's about preparing for future expansion and ensuring that businesses can operate efficiently in diverse financial landscapes. In essence, for a smooth cross-border selling experience, the broader the paytech's bank reach, the better.

Unified payment compliance across MENA

For seamless cross-border selling across MENA, choosing a regional paytech provider who's regulated in all the countries you're targeting is also important. A paytech provider with broad regulatory approval streamlines your operations.

Without such a provider, you might find yourself navigating a maze of regulations and potentially partnering with different paytech providers in each country.

This scenario leads to additional integrations, multiple contracts, duplicated efforts, and unnecessary complications.

Conclusion: The cross-border eCommerce opportunity in MENA

Embracing local payment gateways allows businesses to effectively bridge the gap between their offerings and MENA's varied consumer base. It's a scenario where everyone wins—consumers relish in their trusted payment methods, and businesses witness increased trust, conversion rates, and overall sales.

The future for MENA eCommerce isn't just about having a presence; it's about integrating within the region, resonating with its rhythm, and delivering an unmatched localized shopping experience.

At Tap Payments, we've made it our mission to simplify MENA's online payments landscape. By developing a single Application Programming Interface (API) to facilitate access to the region's favored payment methods, we take pride in leading the charge in bridging MENA's varied payment ecosystem. If cross-border eCommerce in MENA is your aim, our payment experts are here to help. Reach out to our payment specialists anytime through our 24/7 live chat, and let's together unlock MENA's vast eCommerce potential.