Accepting Local Payment Methods such as mada, KNET & Benefit in the Middle East

Introducing you to the Fragmented Online Payment Landscape Within the Gulf Council Cooperation (GCC)

Payment behavior in the GCC is highly fragmented from country to country.

If you’re selling anywhere else in the world, you only need to be able to accept Visa, Mastercard, American Express, or even Paypal. As long as you can accept these payment cards or methods, you are good to sell even globally.

However, if you want to sell online in the GCC, you also need to be able to accept the more popular local payment methods available in each country to give your customers more confidence to shop and pay online.

These local payment card schemes are as follows:

mada in Saudi Arabia

Formed by Saudi Payments, this local payment scheme for debit cards in the Kingdom of Saudi Arabia is one of the fastest-growing payment systems in the region with over 30 million mada cards in circulation today and a couple of billion transactions that are routed through this system. mada adoption in eCommerce has also led to nearly 70% of all online transactions in the Kingdom being routed through this local payment scheme since it was first enabled for e-commerce in mid-2018!

KNET in Kuwait

With a little over 6 times more KNET cards being issued in Kuwait compared to credit cards, it’s no surprise that this local payment scheme for debit cards makes up more than 85% of all transactions processed in Kuwait. A couple of billion transactions are routed yearly through this popular local payment method formed by the Shared Electronic Banking Services Company in Kuwait.

Benefit in Bahrain

In Bahrain, 60% of all transactions are routed through Benefit with 40% of the transactions being processed through Visa/Mastercard. As the local payment scheme for debit cards in Bahrain, Benefit has also rolled out BenefitPay, the national electronic wallet payment system, which has secured over 800,000 registered users since its launch in Bahrain, owing to the diversity of features and services accessible in the mobile application

NAPS (Qpay) in Qatar

This domestic payment network formed by the Qatar Central Bank (QCB) for debit cards in Qatar handles over 70% of all online transactions through NAPS compared to payments using credit cards and is growing quickly in popularity with the consumer shift towards online payments.

OmanNet in Oman

Formed by the Central Bank of Oman (CBO), this local payment method for debit cards in the Sultanate of Oman is used for about 70% of all the online transactions making it an important payment method to accept and have enabled on e-commerce websites and mobile apps for those selling in Oman.

Along with increasing trust in your online business, these familiar local payment methods and systems also relatively cost you less as a merchant per transaction in comparison to credit card acceptance for consumer purchases.

How can you accept all these payment methods on your payment gateway?

This depends on the payment gateway that you choose. This process could get complicated for businesses since most payment companies cannot offer all the localized payment methods available.

If they do offer it, this could also take a lot of development work on your end to integrate with your website and mobile app since most payment companies depend on the integration tools provided by the local payment systems.

This is a time consuming and complicated way to integrate with your website or mobile app since each local payment system has a stand-alone integration with various forms of technical payment flows.

At Tap Payments, this is one of the problems we solve by giving businesses the flexibility to enable all the relevant and preferred payment options they need easily with a single unified integration- leading to a seamless payment checkout and payment flow for your customers.

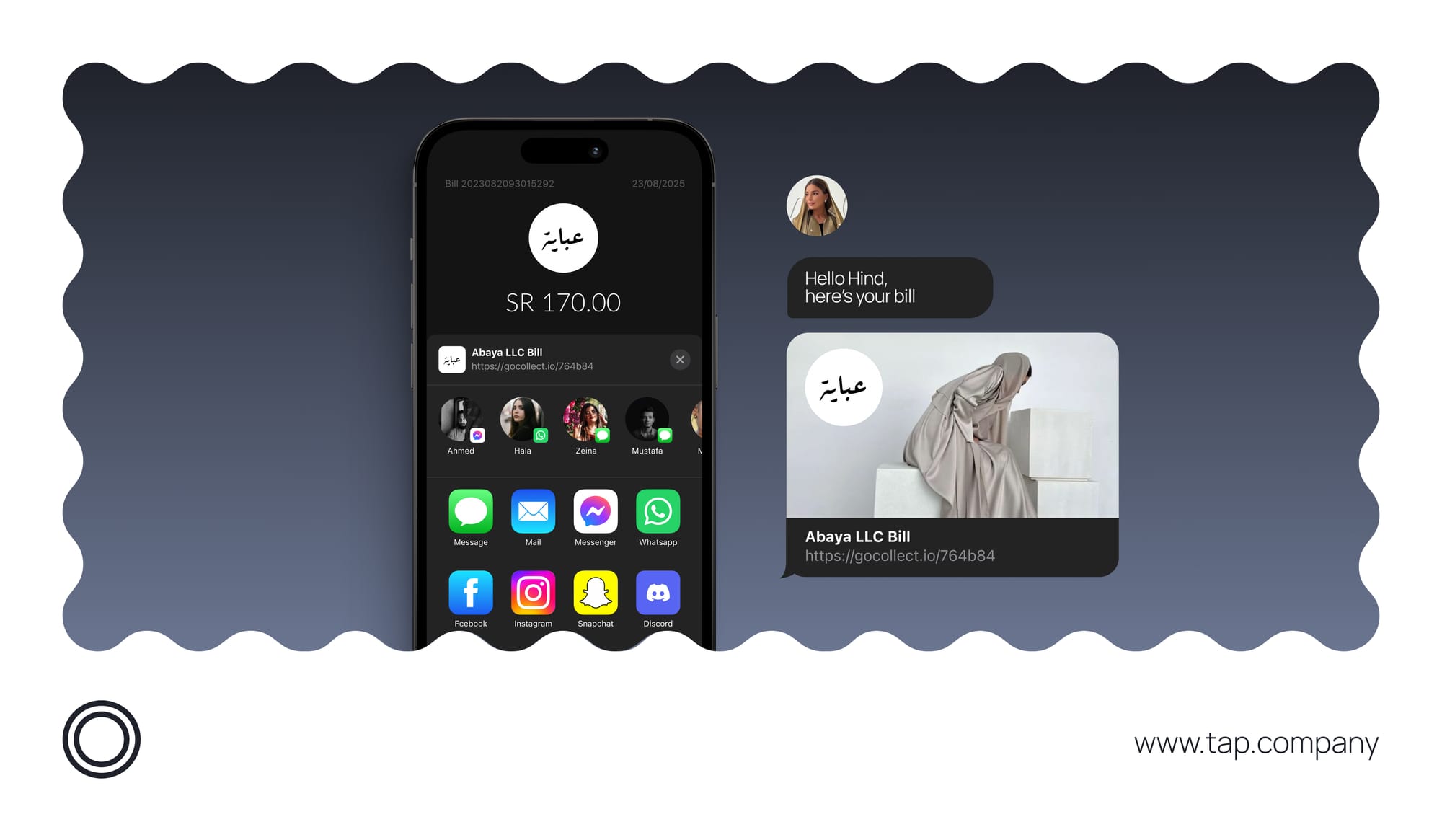

You can easily enable the payment methods on your website or mobile application by integrating with our easy-to-integrate checkout library for websites and/or checkout SDKs for mobile apps.

Based on the country that the customer is from, they will be able to easily select the payment method they want- even if it’s debit cards such as Mada or KNET or credit cards such as Visa, Mastercard, or Amex.

If you’re curious about what our checkout library popup looks like, here you go!

As for businesses who are looking to have a completely native and custom checkout experience on their e-commerce channels, our integration API’s provide a standardized approach that allows developers to integrate directly to each payment system while maintaining a unified technical payment flow.

Tap Payments is also the only payment company that happens to be a financial institution or a Fintech (financial technology) company operating under the supervision of financial regulators and government bodies within the GCC, such as the Saudi Arabian Monetary Authority (SAMA) and the Central Bank of Bahrain amongst many others. Along with being actively involved in developing the Fintech ecosystem in the GCC, such as Fintech Saudi and Bahrain Fintech Bay, this also ensures that Tap Payments is properly regulated and can process all these payment methods securely.

Tap Payments offers its payment services to businesses that are interested in serving their customers in the GCC plus Egypt, Jordan, and Lebanon.

Our payment experts can help your business unlock their growth potential and create the right payment strategy for businesses selling in the GCC and MENA region. Contact our team today through phone, email, or live chat for instant support!