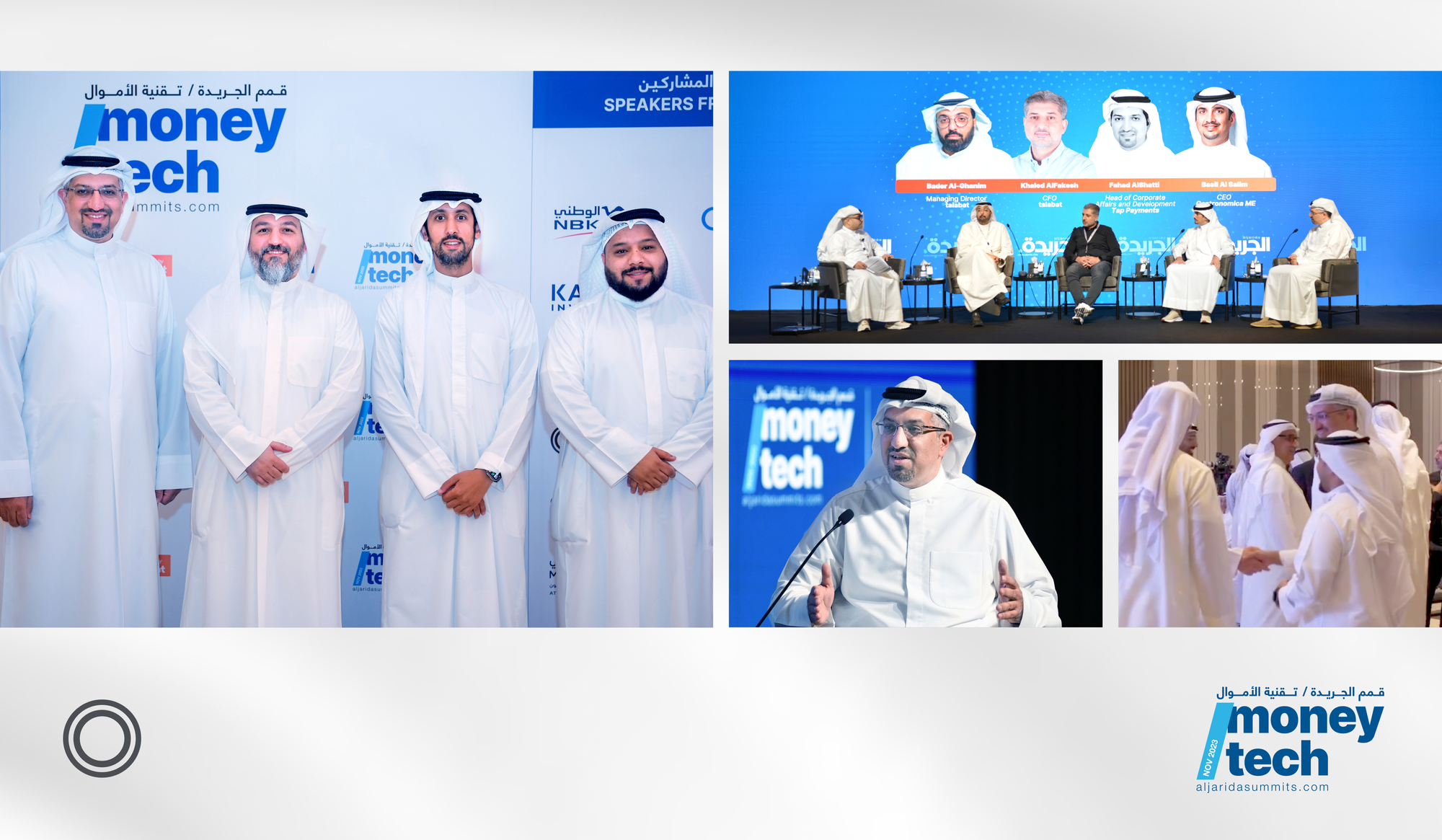

Kuwait Innovation Forum Recap: How Fintech is Shaping Kuwait's Economic Transformation

The Business Year collaborated with the Kuwait Direct Investment Promotion Authority (KDIPA) to host the 2024 Kuwait Innovation Forum, a vital platform for investors, businesses, and regulatory institutions.

For more than 15 years, The Business Year has provided important insights about global markets. It is a key source for investors, businesses, and regulatory institutions. TBY partnered with the Kuwait Direct Investment Promotion Authority (KDIPA) for the Kuwait Innovation Forum.

The forum had well-known speakers and lively discussions. It showed Kuwait's focus on innovation and economic progress.

Faisal Alharoun, our Managing Director in Kuwait, participated in the panel titled "Pioneering Digital Innovation in Kuwait"

The panel featured a discussion with notable figures including Sheikh Ahmad Duaij Jaber Al Sabah, Dalal Alrayes, and David Rutter along with our Managing Director, Faisal Alharoun. Alex Krunic was the moderator.

The Main Fintech Takeaways for Kuwait Businesses:

1. Navigating Kuwait's Fintech Landscape:

Businesses in Kuwait must be mindful of local nuances and preferences. Tailored strategies, developed with a deep understanding of the consumer and regulatory landscape in Kuwait, are crucial for success.

2. Leveraging Kuwait’s Fintech-Friendly Regulations:

Kuwait’s progressive regulatory environment is a significant advantage for local businesses. Embracing these regulations can not only ensure compliance but also open doors to innovation, collaboration, and growth opportunities.

3. Forging Strategic Partnerships:

Collaboration between fintech firms and traditional banks is no longer optional; it’s a necessity. Businesses in Kuwait should proactively seek out partnerships to leverage complementary strengths, accelerate innovation, and deliver superior customer experiences.

4. Embracing Emerging Technologies:

Blockchain, AI, and digital currencies are reshaping the global financial landscape. Businesses in Kuwait that embrace these technologies early can gain a competitive edge, improve efficiency, and tap into new revenue streams.

5. Capitalizing on the Growth of Digital Payments:

The growing demand for digital and mobile payments in Kuwait presents a lucrative opportunity. Businesses should explore innovative payment solutions to cater to evolving consumer preferences and enhance their operational efficiency.

The 2024 Kuwait Innovation Forum

Unlocking Kuwait's Digital Potential with Tap Payments 💳

At Tap Payments, we are dedicated to improving digital services and making sure everyone can access financial services in the region. Today, Tap powers over a hundred thousand businesses of all sizes across all industries and is growing at an extraordinary pace. Since our arrival, we’ve helped small and medium businesses across MENA accept payments within days with billing and operational capabilities that rival the region’s largest corporations.

Interested in enhancing your business with cutting-edge payment products? Visit our website to learn more about Tap Payments and explore the possibilities in payments and fintech.

You can also read Faisal Alharoun’s interview with TBY magazine here, and you can learn more about Tap Payments new EPSP License here.