MoneyTech Summit by AlJarida: Driving the future of fintech innovation in Kuwait

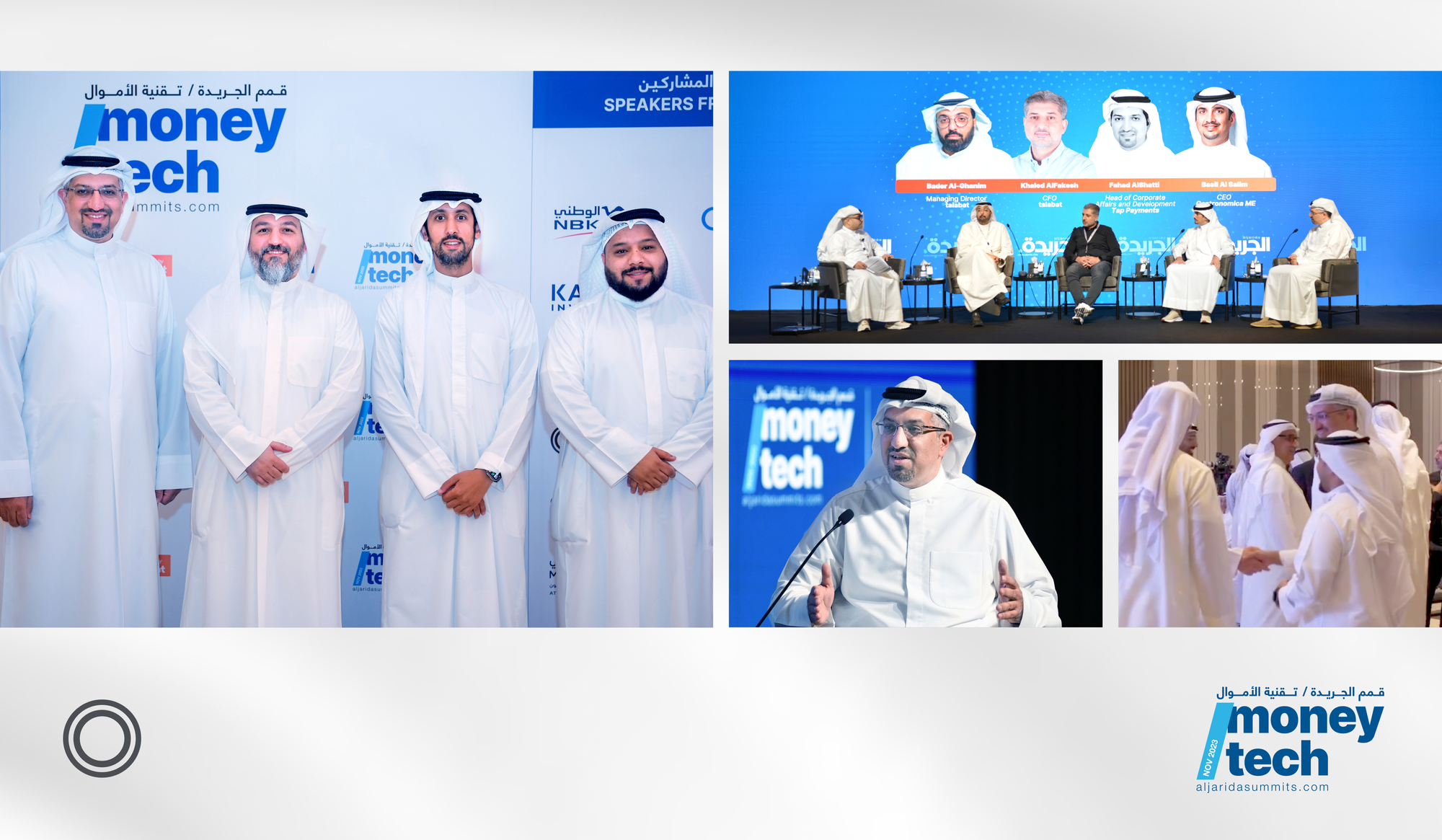

The MoneyTech summit in Kuwait has concluded its second electrifying year, bringing together the brightest minds in fintech. Over 300 trailblazers from business, and technology attended, turning the summit into a vibrant forum that shared breakthroughs and strategies for economic transformation in Kuwait and beyond.

The MoneyTech summit has become a hub for analyzing fintech complexities, spotlighting digital banking advancements, and revealing how artificial intelligence can revolutionize service industries.

This year's event not only highlighted the pivotal trends but also set the stage for the next wave of financial innovation. Digitalization took the spotlight, marking a collaborative effort by government, private sectors, and banks to innovate and reshape the financial landscape.

Kuwait's fintech surge: Digitization at full throttle

MoneyTech peeled back the curtain on Kuwait's financial sector evolution. With the nation's youth fully connected by near-universal advanced internet access, banks are now deploying strategies to capture this digitally savvy demographic. The transformation is tangible, with the rise of entirely digital bank branches marking a new era for Kuwaiti banking. This digital leap is in lockstep with Kuwait's strong market—a firm foundation for the growing private sector.

The landscape has been reshaped by a significant shift in consumer behavior, strategic geographical expansion, and notably, regulatory reforms that empower home-based businesses. These developments are the keystones of Kuwait's impressive digital transformation in recent years, painting a future where fintech is not just an industry, but a cornerstone of the national economy.

Tap Payments at MoneyTech 🚀📈

Our Head of Corporate Development and Affairs, Fahad Alshatti, spoke at a panel titled “Fintech, Foodtech and the Consumer” alongside experts such as Khaled Al Faqsh, CFO of Talabat; Bader Al-Ghanim, Managing Director of Talabat; Basil Alsalem, CEO at Gastronomica ME; and moderated by Abdullah AlBaker, CEO of AlBaker & Associates Law Firm.

The panel explored the convergence of food and finance technologies and how they're reshaping consumer experiences in the digital age!

During the discussion, AlShatti shed light on Kuwait's encouraging progress since October 2022, notably mentioning the introduction of "Apple Pay" in partnership with "KNET". He also highlighted the necessity of improved legislative collaboration and highlighted the importance of precise data reporting to successfully identify the gaps and opportunities in the open banking and fintech market.

"Kuwaiti entrepreneurs are making big waves across the region, thanks in no small part to the Central Bank's pivotal role in sculpting a market ripe for innovation and growth. It's a testament to the vigor and vision of the Kuwaiti ecosystem, supported by a government keen on turning potential into progress."

Faisal AlHaroun, our Managing Director in Kuwait, also had an interview with AlJarida where he discussed how the recent regulatory shifts in the country have brought fintech companies to a level playing field, fostering an environment of innovation.

"Fintech is a fast-paced and dynamic industry, ever-changing and pulsating with new ideas. Challenges are our stepping stones, whether it's conquering technical hurdles, talent scarcity, or regulatory gaps. Instead of looking at these as obstacles, these challenges spark a collaborative spark within us. They encourage us to engage more closely with Kuwait's regulatory authorities, fostering a dialogue that underscores the positive economic impact of our innovations"

Faisal hopes for Tap Payments to establish Kuwait as a beacon of fintech excellence on the global stage. His leadership is not just about navigating the company through the evolving financial landscape but also about championing Kuwait as the hub of fintech innovation in the region.

Forward together: Concluding the second edition of Moneytech Kuwait

As the MoneyTech summit concludes, we're reminded of the vital role such events play in fostering industry collaboration and spurring innovation. They provide a forum for fintech entities to come together, discuss regulatory landscapes, and share advancements that shape our economic future.

As we look to the next summit, Tap Payments is eager to showcase our progress and explore new opportunities for innovation. We'll see you at MoneyTech next year, ready to dive into another year of fintech advancements in Kuwait.