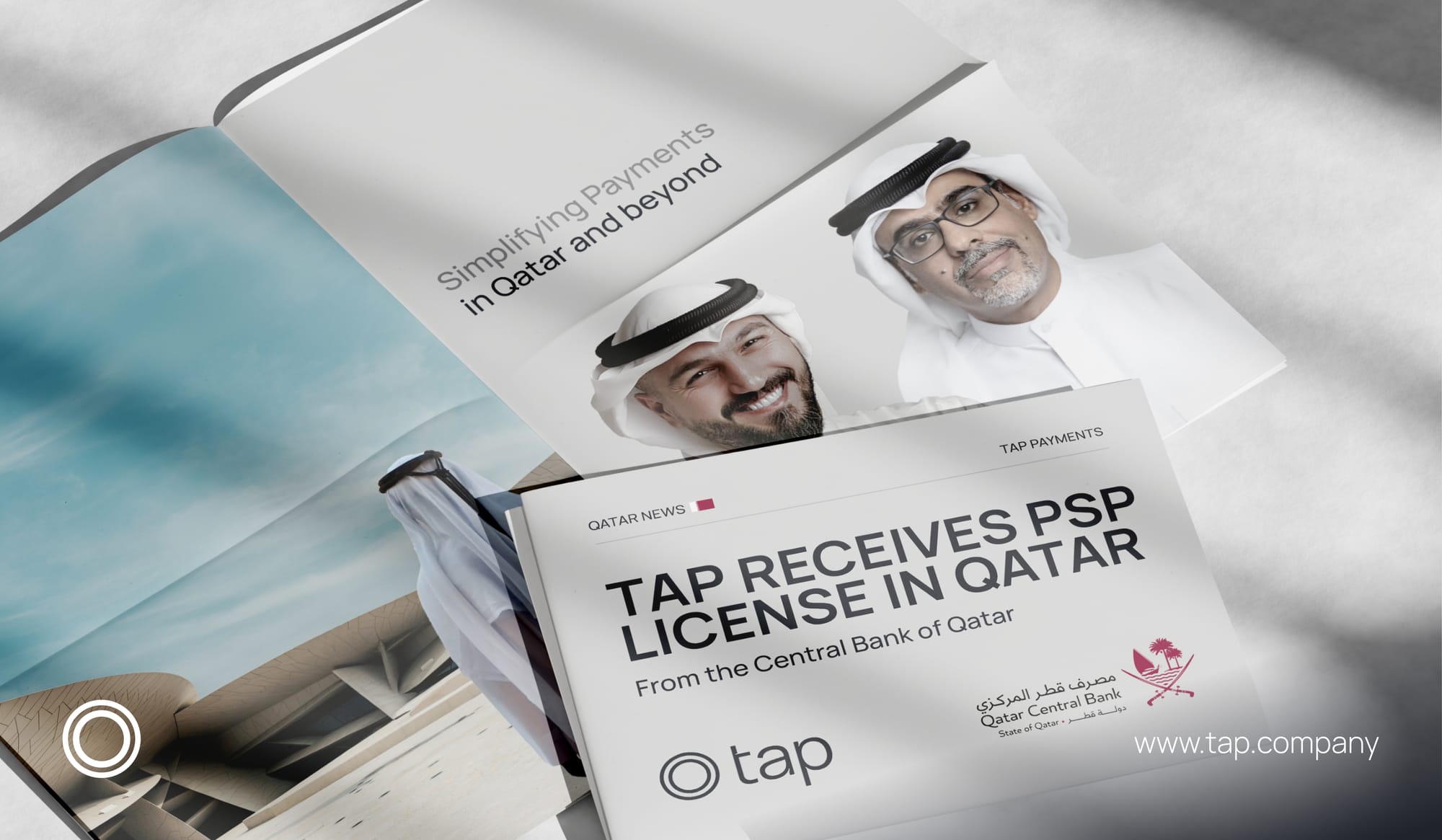

Tap Payments Achieves New Milestone with new Payment Service Provider (PSP) License from Qatar Central Bank

Tap Payments accelerating Fintech Innovation in Qatar and the MENA Region.

Doha, Qatar, May 2024 – Tap Payments celebrates a major milestone, receiving its Payment Service Provider (PSP) license from the Qatar Central Bank.

This is a major milestone for Tap Payments, further solidifying our position as a leading Payment Services Provider (PSP) in Qatar and the wider MENA region. This achievement aligns perfectly with the latest business regulations for payment service providers issued by the Qatar Central Bank in May 2024.

This achievement highlights Tap Payments’ commitment to compliance, innovation, and excellence in financial technology. It also highlights our effort to unify the region and connect it to the global market, while aligning with Qatar National Vision 2030.

Ali Abulhasan, Co-Founder & CEO of Tap Payments, expressed his appreciation for the collaborative efforts that led to securing the license:

Ahmed AlMunayes, Managing Director of Tap Payments, Qatar, reflected on the recent licensing milestone:

This achievement is a testament to our shared commitment to innovation, financial inclusion, and the advancement of Qatar's digital economy.

We look forward to leveraging this license to deliver cutting-edge payment solutions that empower businesses and consumers across the nation."

With a strong presence since 2014, and serving over 100,000 businesses across nine markets including Qatar, Saudi Arabia, Kuwait, UAE, Bahrain, Oman, Egypt, Jordan, and Lebanon, Tap Payments is positioned to drive innovation and expansion in the fintech sector.

Media Coverage:

Explore some of the media coverage:

Visit our website to learn more about Tap Payments.