Tap Payments Partners with the World Economic Forum to Simplify Cross-Border Payments for SMEs

Cross-Border Payments Have Been Broken for Too Long. That’s Changing.

For SMEs looking to expand internationally, cross-border payments aren’t just a challenge. They’re a maze of fees, delays, and regulations. Big banks move slowly. Regulators struggle to keep up. And small businesses, the backbone of global trade, end up paying the price.

But change is finally coming. Thanks to the World Economic Forum and IDB Lab, outdated barriers are coming down. The PAGA Initiative is leading the charge, making digital payments simpler, faster, and more accessible for businesses ready to scale.

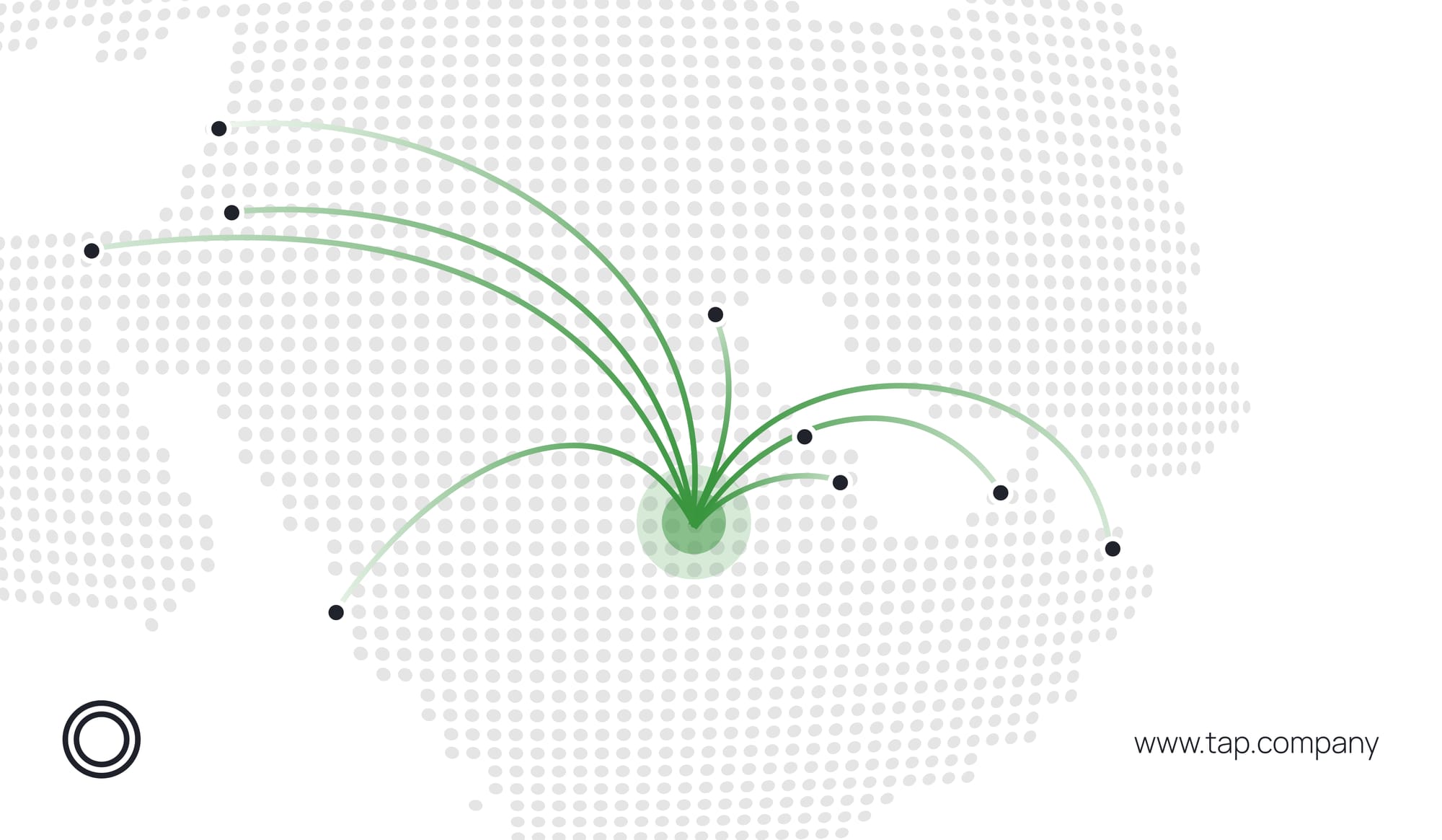

Tap Payments Helping MENA SMEs Expand Beyond Borders

Imagine an eCommerce brand based in the UAE looking to expand into Saudi Arabia. They’ve built demand but run into a major challenge—most Saudi customers prefer to pay with mada, but their existing payment provider doesn’t support it. On top of that, international card fees are eating into their margins, and settlement times are slowing their cash flow.

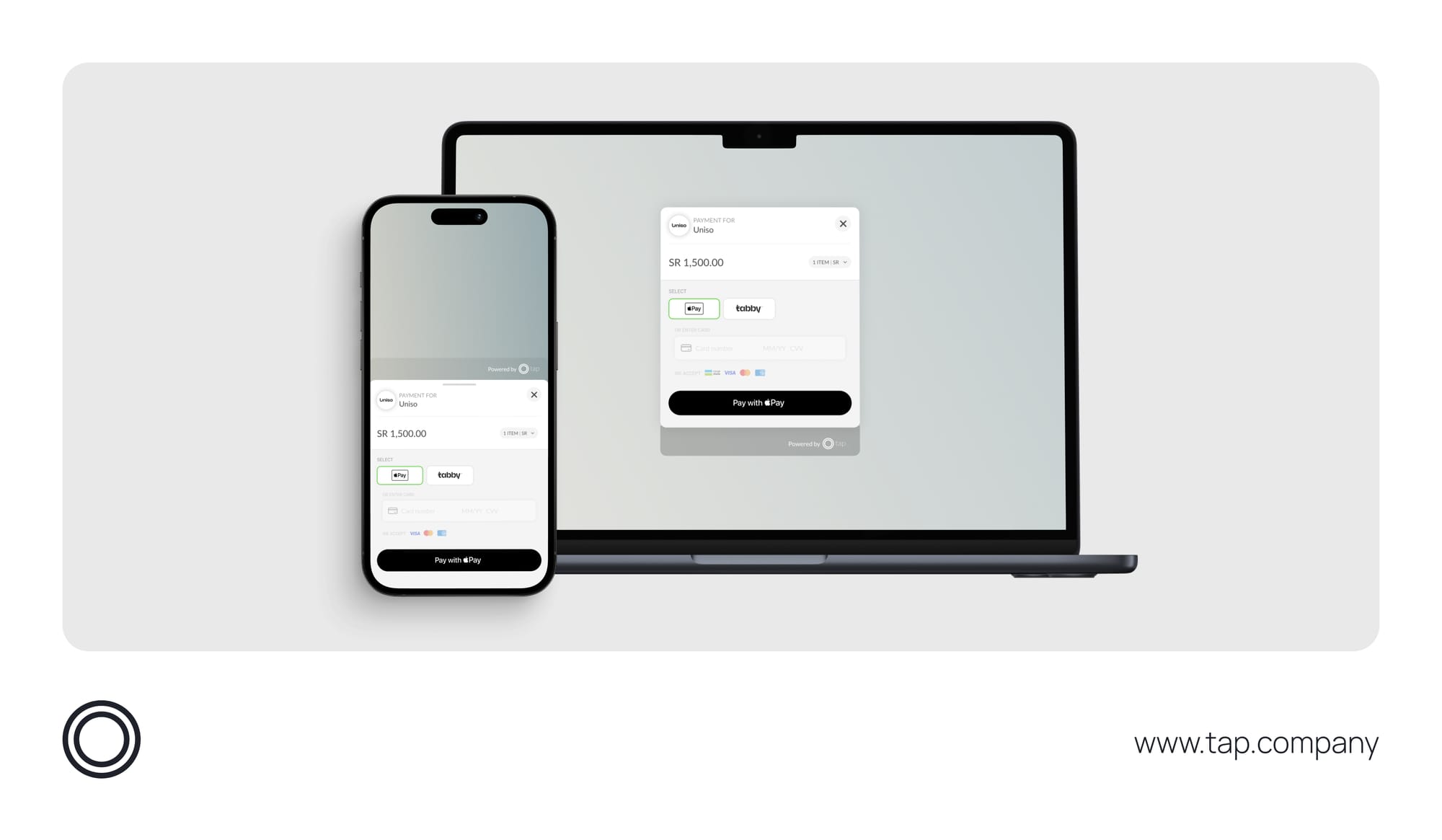

This is where Tap Payments removes friction. SMEs can now accept payments from anywhere, whether it’s mada in Saudi Arabia, KNET in Kuwait, Visa and Mastercard globally, Benefit in Bahrain, or Apple Pay and PayPal across markets. Just to name a few.

With faster settlements, lower fees, and easy integrations, Tap Payments helps businesses scale smoothly between the UAE, Saudi Arabia, and beyond—without payment barriers slowing them down.

How Tap Payments Helps SMEs Grow?

Tap Payments offers powerful features designed for seamless, scalable cross-border payments:

- Comprehensive Payment Coverage – Accept all major payment methods across MENA and beyond, including mada, KNET, Visa, Mastercard, Apple Pay, PayPal, and BNPL options like Tabby.

- Easy Integration – Plug and play with SDKs and APIs that let businesses start accepting payments in minutes.

- Smart Payment Controls – Reduce refunds and chargebacks with tools like Authorize, which lets merchants temporarily hold funds.

- Marketplace-Ready – Built-in split payments and automation help SMEs manage complex marketplace transactions.

- Instant Local Bank Transfers – Get paid instantly with direct transfers to local bank accounts—no unnecessary delays.

- Enterprise-Grade Security – Advanced fraud detection and biometric authentication ensure every transaction is protected.

- Multi-Currency and Language Support – Serve local and international customers with seamless multi-currency and multi-language capabilities.

Why Cross-Border Payments Matter for SMEs?

To understand why cross-border payments are such a big deal for SMEs, let’s break it down.

1. Why Have Cross-Border Payments Been So Difficult?

International expansion should be an opportunity, not an operational nightmare. Yet, SMEs face:

- High transaction fees that eat into already thin margins.

- Slow payment processing that delays cash flow.

- Complicated regulations that create compliance headaches.

When these challenges are removed, businesses can grow faster, enter new markets, and compete on a global scale.

2. How Do Better Cross-Border Payment Solutions Help SMEs?

A smoother payment process means:

- Lower costs – More revenue stays with the business.

- Faster transactions – No more waiting days for settlements.

- Seamless global access – Sell anywhere without friction.

3. What Are the Biggest Barriers Right Now?

- High banking fees – Traditional banks still charge outdated, excessive cross-border fees.

- Regulatory red tape – Many countries have restrictive payment policies.

- Lack of local payment options – Consumers prefer familiar payment methods, and SMEs struggle to offer them.

Fixing these issues doesn’t just benefit SMEs. It’s a game-changer for the entire global economy.

The Role of Public-Private Partnerships in Cross-Border Payments

Governments, financial institutions, and fintechs need to work together to remove roadblocks. Public-private partnerships help:

- Standardize regulations so businesses don’t have to navigate fragmented compliance rules.

- Improve interoperability between payment systems so transactions flow smoothly.

- Increase financial inclusion, ensuring small businesses aren’t shut out of global markets.

How the PAGA Initiative Empowers SMEs?

The PAGA Initiative is at the forefront of simplifying cross-border payments and ensuring that SMEs are no longer locked out of international trade.

By pushing for better financial infrastructure and forming strategic partnerships, PAGA creates an ecosystem where SMEs can scale without being held back by outdated payment systems. Highlighting key payment providers like Tap Payments, PAGA showcases how modern fintech solutions are changing the game for small businesses worldwide.

The World Economic Forum’s Role in Fixing Cross-Border Payments

The World Economic Forum (WEF) recognizes that broken cross-border payments slow down global trade and limit economic growth.

Its research highlights key barriers:

- Regulatory fragmentation – Different rules across countries slow payments.

- Data localization – Restrictive policies make global transactions harder.

- Licensing complexities – SMEs struggle with compliance due to outdated banking regulations.

By advocating for a unified global approach to payments, the WEF helps create a world where businesses can trade across borders as easily as they do locally.

How Tap Payments and the WEF Are Creating Synergy for SMEs?

Together, Tap Payments and the WEF are solving the biggest pain points in cross-border payments by:

- Lowering transaction costs – SMEs keep more of their revenue.

- Speeding up payment processing – Faster settlements = stronger cash flow.

- Simplifying compliance – SMEs stay compliant without excessive paperwork.

- Enhancing security – Fraud detection and risk management keep businesses protected.

Emerging Technologies vs Cross-Border Payments

Technologies like blockchain and open banking are redefining cross-border payments by making them faster, more secure, and more transparent.

These innovations are eliminating the need for slow, costly intermediaries and putting power back in the hands of businesses.

The Future of SMEs and Cross-Border Payments

With Tap Payments' advanced payment solutions and the WEF’s policy leadership, SMEs now have the strongest opportunity ever to compete globally.

As initiatives like PAGA continue pushing for better digital payment solutions, the future of cross-border payments for SMEs is no longer a dream—it’s happening now.

The Path Forward for SMEs

For years, SMEs have been stuck playing by big-bank rules in a broken system. That era is ending.

With fintech innovation, regulatory progress, and global partnerships, small businesses now have the tools to expand across borders without unnecessary friction.

The only question is: Are SMEs ready to take advantage of it?