Tap Payments Secures License in Egypt, Marking another Key Milestone in MENA

At the heart of ancient history, a glimpse into the future unfolded.

Cairo hosted the RiseUp Summit at the Grand Egyptian Museum. The event brought together startups, builders, and bold ideas from across the region. All focused on shaping the future of the digital economy.

Tap Payments joined the summit in Egypt. Our team connected with innovators, entrepreneurs, and fintech partners.

A Historic Venue for a Modern Milestone

Our Co-Founder and CEO Ali Abulhasan shared the stage with fintech leaders. They spoke about how payments are changing across the region. He talked about the challenges. The opportunities. And the process of building a unified payment experience in a diverse market, during the panel “Beyond Payments: What’s Next for Fintech in MEA.”

Against the backdrop of Egypt’s timeless heritage, Tap Payments reached a new milestone. We became officially licensed as a Payment Facilitator and Service Provider in Egypt, from the Central Bank of Egypt. Our latest license in the MENA region.

"Our vision from day one has been to simplify and unify payments across MENA. Every market in the region is unique, that’s what makes it exciting, but also challenging. Getting regulated isn’t easy, and it never will be. But that’s why collaboration matters. The future of payments in MENA will be built through partnerships between fintechs, schemes, and regulators working together to connect the region more than ever.” Ali Abulhasan Co-Founder and CEO of Tap Payments.

This license reflects our commitment to unify payments across the region, with licenses in Kuwait, Saudi Arabia, the UAE, Bahrain, Qatar, and now Egypt. Together, they form the foundation for local infrastructure that helps businesses accept and manage payments in every market.

A Fragmented Region, A Unified Experience

MENA is a region of many markets. Each one has its own rules, habits, and local payment systems. From mada in Saudi Arabia to Meeza and Fawry in Egypt, building a smooth experience across them isn’t easy. But it’s a challenge Tap Payments is up for.

Why Egypt Matters

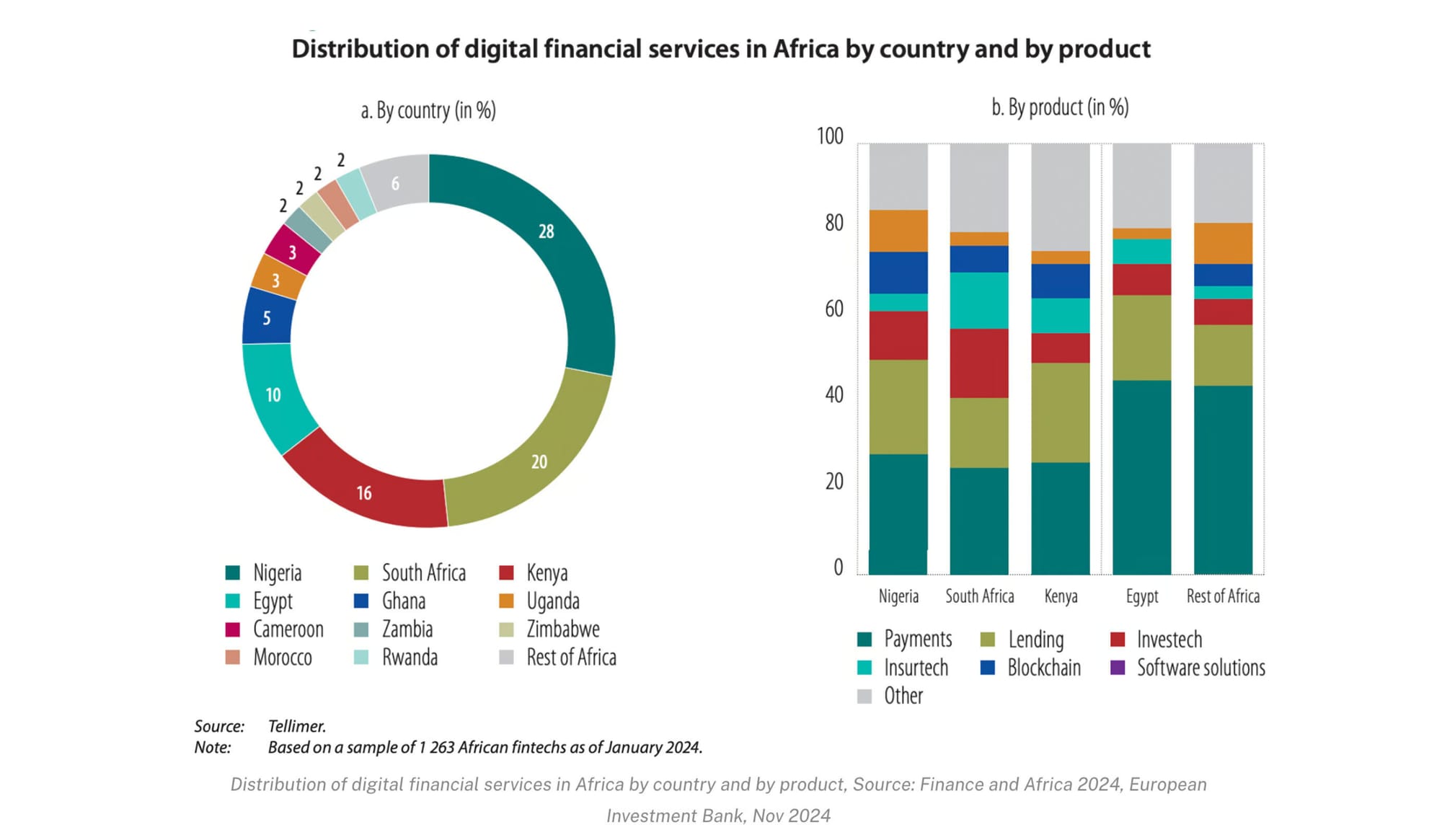

Egypt’s fintech scene is growing fast. In 2024, the country led fintech investment, securing 35% of fintech funding in Africa. Today startups, SMEs, and digital-first consumers are driving the shift.

With our new license, we’re stepping into the market at its foundation. Ready to support what comes next.

If you’re a startup in Cairo, a business in Alexandria, or a brand expanding across the region, Tap Payments makes payments the easiest part of your growth.

As Tap Payments continues to grow, our commitment remains clear.

Local expertise. Regional reach. Unified experience.

Because the businesses of tomorrow deserve a payment partner who understands both the beauty and complexity of MENA, and is licensed to act on it.

Stay tuned to see where we go from here!

Want to accept payments in Egypt and across MENA? Email us at hello@tap.company or visit our website to get started.