The Complete Guide to Marketplace Payments in MENA

Scale Marketplace Payments Across Borders Without Breaking Compliance or Trust.

The MENA eCommerce market is growing rapidly, but scaling a marketplace in this region is not just about signing up sellers and attracting buyers. Your payment infrastructure decides whether your business succeeds or gets buried in complexity. Getting it wrong results in delays, regulatory fines, and lost trust from buyers and sellers.

Why Marketplace Payments Are Different

Marketplace payments are tougher than standard eCommerce transactions because they juggle multiple sellers, currencies, and compliance checks, often in real time across thousands of orders.

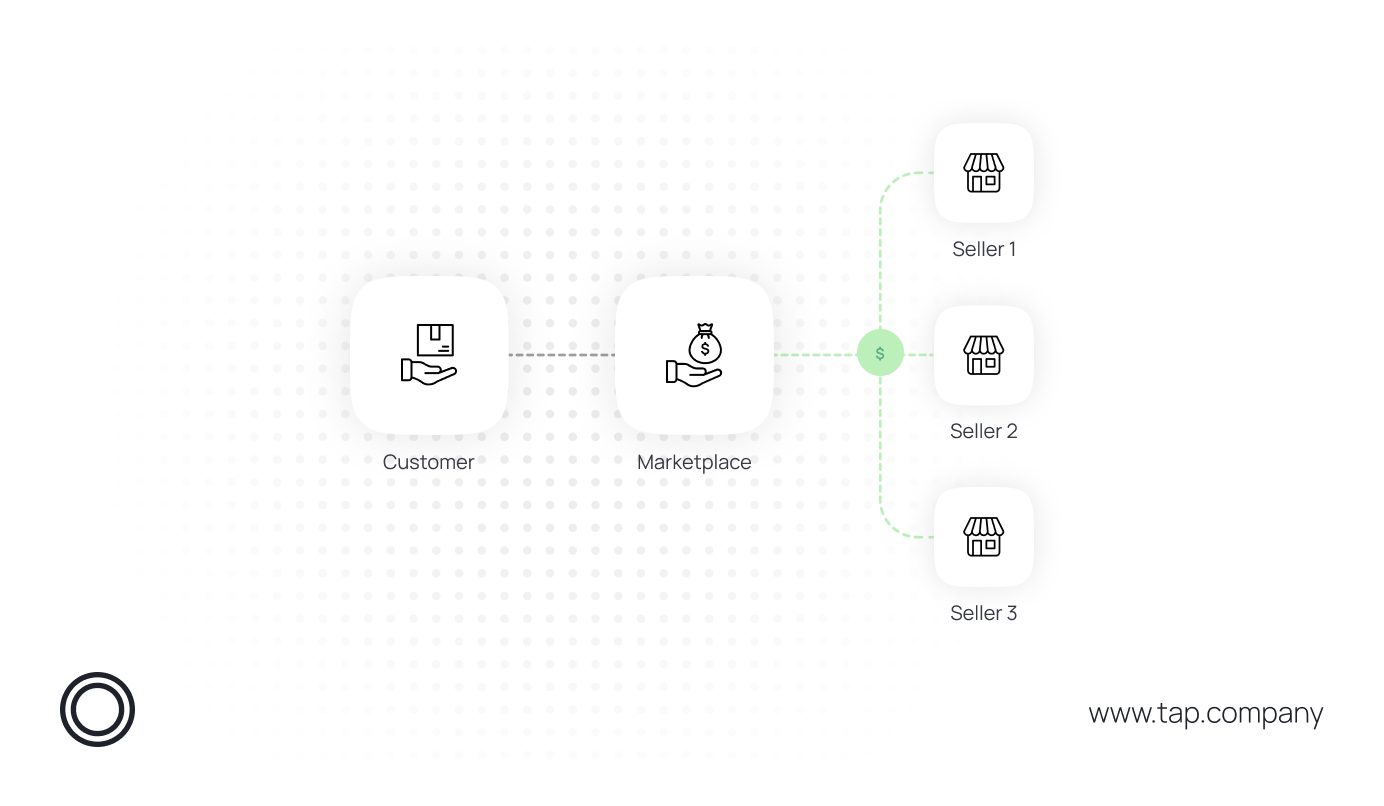

Typical Purchase Flow

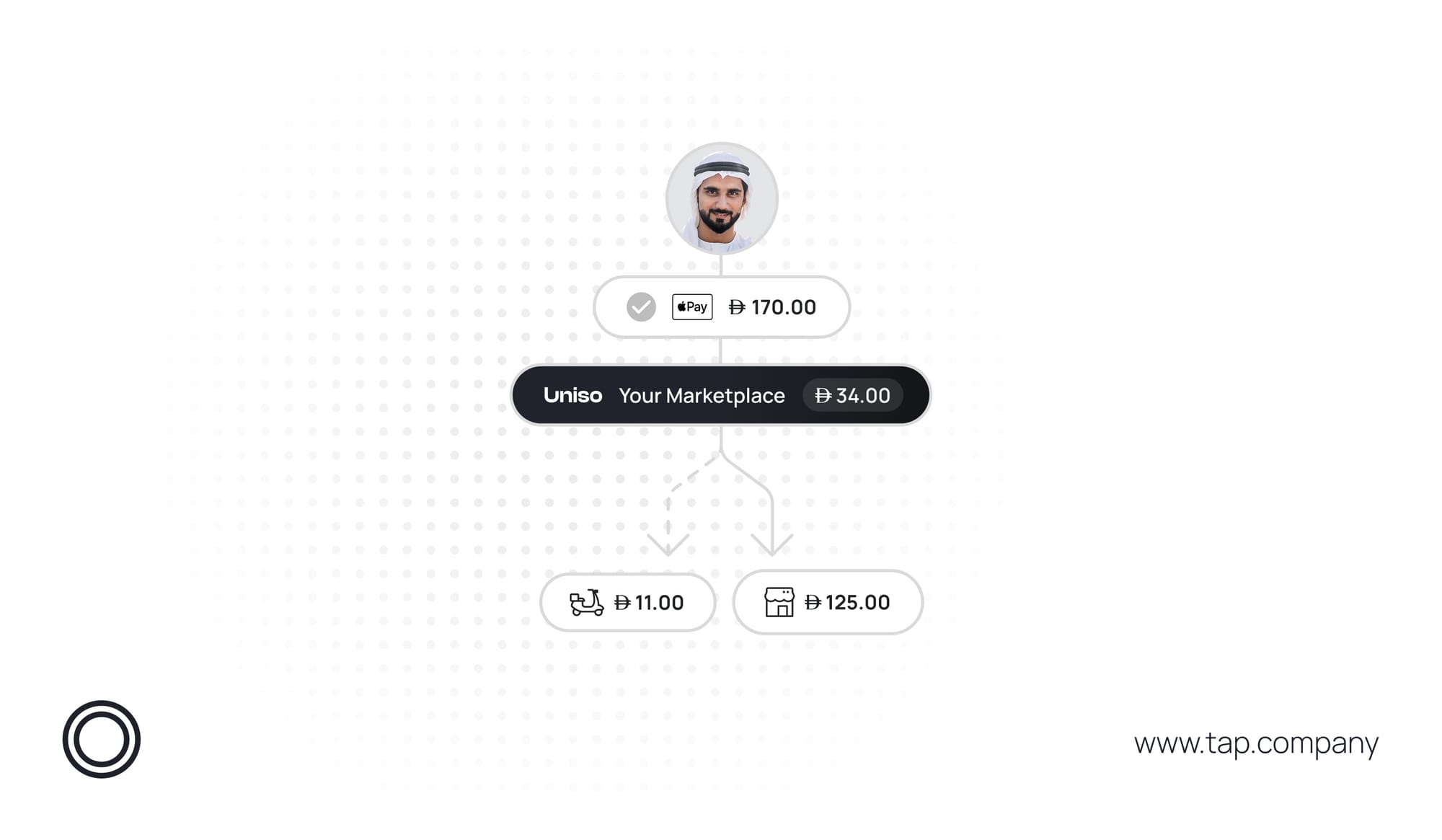

A customer in Dubai buys from three sellers on one marketplace.

The platform:

- Collects a single payment.

- Holds the funds in a wallet or escrow account.

- Confirms each delivery.

- Splits and pays out to every seller.

- Handles different payout methods, bank accounts, and local rules.

Now scale that across thousands of daily transactions, each with its own currency, payment flow, and local regulatory requirements. Without a solid payment system, complexity spirals fast.

Key factors that make marketplace payments different

- Multiple sellers with unique payout methods and bank accounts.

- One customer payment that must be split accurately and fast.

- Layered compliance (KYC, KYB, fraud checks).

- Timing pressure—any payout delay erodes seller trust.

A marketplace is only as strong as its payment infrastructure. When it works, sellers and buyers move without friction.

Navigating Regulatory Requirements

Whether you need a licence depends on your model. If you let a licensed payment provider collect and distribute funds, the marketplace itself may not need a separate licence. If you hold or manage funds directly, most MENA regulators require approval.

Beyond licences, many regulators demand:

- Regular audits and reporting.

- Robust KYC/KYB processes.

- Capital reserves or safeguarding accounts.

- On‑shore processing (e.g., Saudi card traffic must pass through mada).

Shortcut: Partnering with a regulated provider lets you offload most obligations while keeping visibility over each country’s rules.

Key Regulatory Considerations for Marketplaces

If your marketplace holds or manages funds directly, meeting local regulatory requirements is crucial.

In many MENA markets, consider the following:

- Licensing and capital: Secure the right PSP or e‑money licence and maintain reserves.

- Local processing: Domestic transactions may need in‑country gateways.

- Audits and reporting: Expect periodic compliance reviews.

- KYC / KYB: Verify both buyers and sellers.

- Fund holding and escrow: Many markets require safeguarded client accounts.

The Core Payment Infrastructure

A successful marketplace payment system is built on three foundational capabilities:

1. Money Collection

Going beyond a gateway, you need:

- Multi‑currency processing.

- Real‑time fraud screening (3‑D Secure, AI models).

- Local payment methods: mada (Saudi), KNET (Kuwait), Fawry (Egypt), BenefitPay (Bahrain), Apple Pay, Google Pay, and many more.

2. Fund Management

- Securely hold funds, calculate commissions, and keep clean audit trails.

- Escrow builds trusts, sellers are paid only when orders are confirmed.

- Partner with PCI DSS Level 1 providers for data security.

3. Payout Management

- Bank transfers, digital wallets, or prepaid cards.

- Flexible schedules (daily, weekly, monthly).

- Automated reconciliation so every seller gets the right amount.

Managing Cross-Border Complexity

Many marketplaces operating across multiple MENA countries, create currency, compliance, and banking complexities.

1. Currency Management

- Exchange Rate Fluctuations: Affect seller payouts if not managed properly.

- Dynamic FX Strategies: Lock in favorable rates to ensure predictable settlements.

- Multi-Currency Accounts: Reduce conversion costs and speed up settlements.

2. Regulatory Compliance

- Cross-Border Payment Licenses: May be required depending on your operational model.

- In-Country Processing: Some markets restrict foreign fund flows, mandating local gateways.

- Transaction Reporting & Documentation: Must align with local laws in each jurisdiction.

Cross-Border Best Practices

The Challenge of Marketplace Payouts

A Saudi customer pays in SAR for goods from UAE and Egyptian sellers.

The platform must:

- Obey three regulatory frameworks.

- Transfer funds cross‑border without costly delays.

- Convert currencies at competitive rates.

- Respect each seller’s payout schedule.

- Support bank transfers, local wallets, or cards.

Managing Risk Without Killing Growth

Payment risk in marketplaces comes in three forms:

- Seller Risk: Fraudulent or low-quality sellers can damage buyer trust.

- Implement KYB (Know Your Business) verification.

- Use real-time monitoring and tiered onboarding requirements.

- Deploy AI-driven tools to flag suspicious behavior.

- Buyer Risk: Preventing fraud, chargebacks, and disputes is critical, especially for cash-on-delivery models.

- Use strong authentication (e.g., 3D Secure).

- Employ AI-driven fraud detection.

- Offer a clear, transparent dispute resolution policy.

- Platform Risk: Regulatory compliance, currency exposure, and infrastructure failures can disrupt operations.

- Partner with a PSP that specializes in MENA compliance, multi-currency processing, and automated reconciliation.

- Maintain robust disaster recovery and business continuity plans.

Getting Started Right

If you’re building or scaling a marketplace in MENA, start by:

- Mapping every payment flow, including refunds and chargebacks.

- Check regulatory requirements in each market.

- Choose a payment provider with marketplace expertise.

- Build trust mechanisms such as escrow, fraud prevention, transparent refunds.

- Plan for scale so volume spikes don't break your ledger.

Choosing the Right Payment Partner

Your marketplace needs a payment partner that understands marketplace-specific payment flows, MENA regulations, local payment preferences, and cross-border complexity.

Ask potential partners:

- Are you licensed across MENA?

- Do you support real‑time split payouts?

- Can you handle multi‑currency settlement?

- What fraud tools do you run?

- How do you stay compliant with each regulator?

Key Takeaways

Building payment infrastructure for a MENA marketplace is complex, but it can be a massive competitive advantage when done right. The platforms that master payments don’t just move money, they build trust, accelerate growth, and ultimately dominate their markets.

- Marketplace payments in MENA need purpose‑built infrastructure for split payouts, local rails, and strict compliance.

- Regulation is continuous such as licensing, KYC/KYB, audits, on‑shore routing.

- The right partner lifts the back‑end load so you can focus on growth.

- Risk management covers sellers, buyers, and your own licence obligations.

- Design for scale from day one; retrofitting payments later is painful.

Work with Tap Payments

If you’re building or scaling a marketplace in MENA, delivering a secure, and compliant payment experience is critical.

Tap Payments is a regulated payment institution and payment technology provider, offering customizable products designed specifically for marketplaces, covering split payments, automated payouts, and local payment options like mada, KNET, Benefit (and many more).

Whether you need secure card storage, cross-border processing, or multi-currency support, Tap Payments helps optimize your payment flows while ensuring full regulatory compliance, so you can focus on scaling your business.

Chat with us live on our website or email us at hello@tap.company to explore how we can power payments for your marketplace.